Bybit.com Review 2021 – Pros and Cons of Trading on Bybit

Denis Denisov

Registration

Bybit welcome bonusThe Bybit cryptocurrency broker platform is operated by the Bybit Fintech Limited which is registered on the British Virgin Islands, with headquarters in Singapore. The company was launched in March 2018, making it still a fairly young player on the crypto market.

The company has about 90 employees, all of whom joined within a year. The development team created the trading platform in just over half a year, knowing that the system had to be as close to perfect as can be.

This is because no mistakes are allowed to happen when traders with high stakes risk a lot of money on a derivatives trading platform, not even in the area of cryptocurrency. As Bybit is focused on the more experienced traders, the platform has grown in a short time to become a well-known name on this highly competitive market.

Experienced traders are especially charmed by the platform’s high speed performance. According to Bybit‘s own statements they can handle 100,000 transactions per second. This has the advantage that you lose as little money as possible when trading, which can otherwise happen on overloaded platforms. With it’s high technical standard, the platform is ready for the future. Due to the ever increasing popularity of crypto trading all brokers will become busier and busier, which means that many transactions per second are no superfluous luxury.

Registration

Bybit Review – Trading Interface

Especially in terms of functionalities, Bybit distinguishes itself from the rest. This way you can trade on margin on the platform. With some cryptocurrencies it’s even possible to use leverage of up to 1:100. This means that you would only have to deposit 0.01 BTC to be able to open a 1 BTC position. With leverage you can still make a lot of profit with only a small investment, but you can also lose your margin just as quickly. With leverage of 1:100 this is certainly the case which is why professional traders usually never use it to that extend. With this amount of leverage the liquidation price will just be too close to your entry, so it’s hard not to get liquidated in that case.

In fact, most pro traders use a formula that calculates the position size based on their stake in relation to the amount they are willing to lose in one trade. Leverage in general is a functionality for the more experienced trader, and high leverage is rather for the gambler.

The fact that Bybit is especially suitable for experienced traders doesn’t mean that there is no support available. If you have any questions, you can contact them 24/7 via a live chat on the website. The live chat is fully in English as Bybit is not offered in other languages. It is even possible to ask questions to their CEO on Twitter. So Bybit is a very open platform, a fact that makes them seem trustworthy and reliable, more than many other trading sites.

In summer 2019, the platform already counts 100 thousand registered users, with new sign ups coming in every day. Currently Bybit is one of the most popular alternatives to BitMEX.

Registration

Products offered by Bybit – Altcoin Trading Pairs

Bybit offers perpetual crypto derivative contracts on Bitcoin, Ethereum, EOS, and Ripple against USD. It means that by performing a trade, you are not buying an underlying asset, but enter an agreement with the seller for the future price of a given asset.

In order to trade any of the products offered by this platform, you will have to deposit either BTC, ETH, EOS, or XRP, after which Bybit will calculate your available margin, shown in USD.

This margin can be used to enter a short or long position on every currency pair available: BTC/USD, ETH/USD, EOS/USD, and XRP/USD with a maximum leverage of x100.

Bybit Trading Pairs With Leverage:

BTC/USD: 1:100

ETH/USD: 1:50

EOS/USD: 1:50

XRP/USD: 1:50

Signup on Bybit – No KYC / ID Verification

short signup

Bonuses

Creating an account on Bybit is very easy and that’s mainly because Bybit doesn’t need too much data from traders. What you’ll notice with a lot of brokers and exchanges, is that you have to verify some data before you can start. This is especially with traditional regulated brokers, but also with a range of new cryptocurrency brokers.

With Bybit you don’t have to do this. Only an email address is sufficient for Bybit. If you signup with your mobile you need to fill in your country, phone number and password.

After activating your account via e-mail you can get started right away. It might give you a bit of a strange feeling, but actually a specialized cryptocurrency broker doesn’t need anything else from you. You can read below why Bybit doesn’t need your bank details.

Registration

Demo Mode

Bybit is offering a testnet trading account, so new users can check out the trading platform safely before trading with real money. This is a great feature we always appreciate with Bitcoin brokers. Right on their trading interface you find the Testnet link on the right side.

In the illustration you see where you find the testnet link. Btw, this is the night mode which is preferred by many traders who are used to dark charts:

Bybit Review: Demo Account

At the bottom of the page you can change the day or night mode, depending on whether you prefer a white or a black interface.

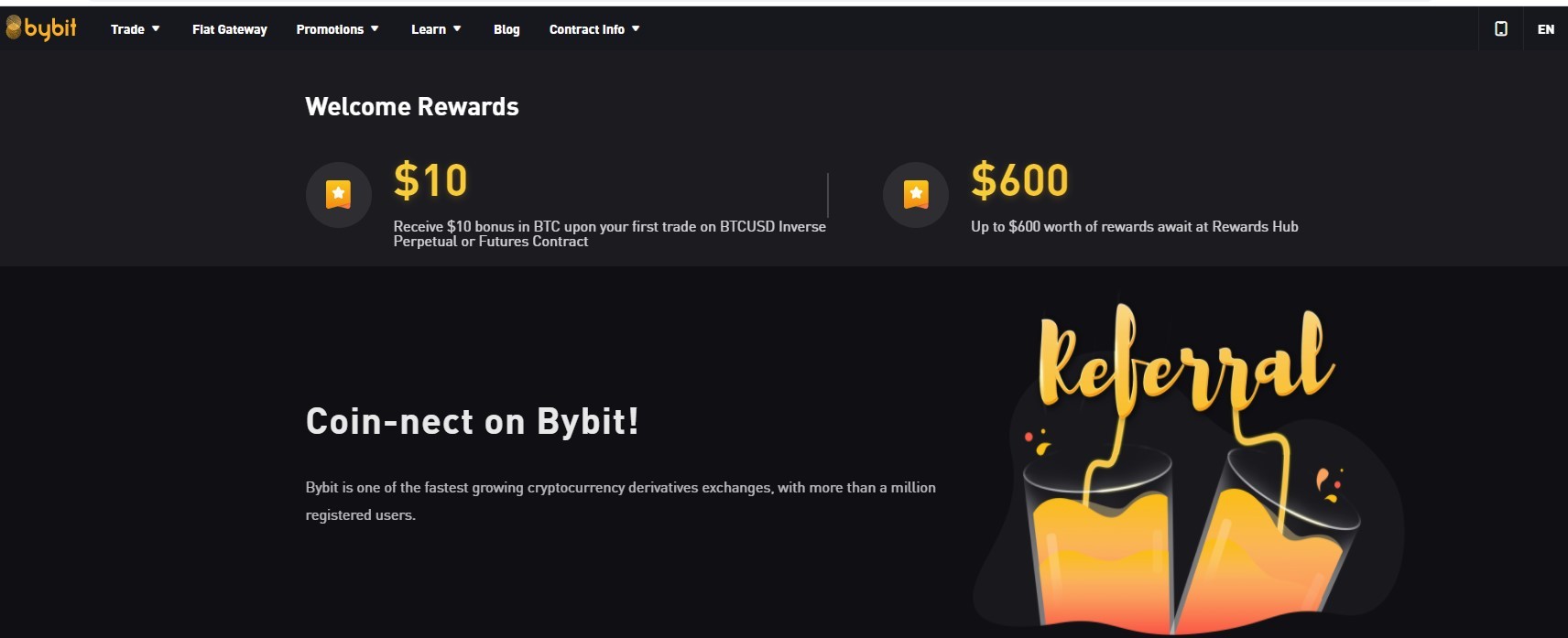

Bybit Welcome Bonuses

One of the cool things about Bybit is that they grant you money in the form of bonuses. Users get a $10 signup bonus and another $50 on their first deposit, so $60 in total. However, a minimum deposit of 0.2BTC is required for this deposit bonus.

In order to get the $10 sign up bonus there is a tiny task you need to do which is following Bybit‘s official on Twitter and retweeting the Welcome Bonus Tweet. You’ll find the details in your account in the bonus section. By the way, this credit cannot be withdrawn, but must be used for trading on the platform. But that goes without saying.

Restrictions

For legal reasons there are certain countries or regions that cannot be served by Bybit. Unfortunately, those are the USA, Québec (Canada), Cuba, Singapore, Crimea, Sevastopol, Syria, Iran, Sudan, China and North Korea. So if you live in one of those countries, unfortunately you’re not allowed to trade on Bybit.

Registration

How does Bybit work?

It is good to know in advance that you can only use cryptocurrency to access Bybit. So you can’t execute trades with USD or Euros to convert them into Bitcoin, for example.

If you want to start using Bybit and you don’t have any cryptocurrency yet, then you’ll first have to go to an exchange to buy Bitcoin or one of the other cryptocurrencies accepted for deposit on Bybit.

With Bybit you can make trades like you might know from BitMEX. At Bybit it is possible to deposit BTC, ETH, EOS or XRP in order to start trading. So it isn’t possible to directly deposit fiat money such as USD, EUR, GBP etc. If you don’t have cryptocurrency yet, you can buy some from CoinMama, BitPanda, LocalBitcoins, Coinbase or another exchange of your choice. The term you have to look for is spot trading, other than CFD trading. Spot trading means you actually exchange one foreign currency against another, so you actually purchase a currency (or, in our case: cryptocurrency). At CFD trading you only trade price differences of 2 currencies, but you only keep one type of asset. The amount of this asset will get enhanced or reduced, depending on the success or failure of your trades.

For each trade in Bybit you can set a leverage and you can indicate whether you want to go long or short. Each trade on Bybit happens through two parties. One party is the maker. A maker places an order in the order book for the future. So a maker will also make sure that the trading platform has money in its hands and will provide liquidity within the broker. A maker receives a reward for this. You can read more about this below. The other party is the taker, who places an order equal to that of the maker. So in short – a maker creates the order book and a taker takes a transaction out of the order book.

Here are the leverage details for BTC and ETH positions:

BTC leverage:

BTC leverage details

ETH leverage:

ETH leverage details

Protection From Market Manipulation

The broker is protected from market manipulation by using a dual price mechanism. This means that the price at which traders can be liquidated depends on the mark price. The mark price is an average price of certain large exchanges.

Deposit and Withdrawal

Minimum Amounts:

There is no minimum deposit for BTC, ETH, EOS and XRP. So on this crypto margin broker you can even trade with tiny amounts, which is a good idea if your are a margin trading beginner. But they do have minimum withdrawal amounts you might need to know – however, even those are really low:

Bitcoin: 0.002BTC

Ethereum: 0.02ETH

EOS: 0.2EOS

Ripple: 20XRP

Registration

Maximum Withdrawal:

The maximum amount you can cash out at once is 10 BTC. Withdrawals are processed manually 3 times a day. So you could withdraw 30 Bitcoin per day in total.

Trading Fees

We’ve just been talking about makers and takers. As a taker you pay a 0.075% fee of your total trading amount to Bybit. As a maker you will receive a 0.025% discount on that amount. If you have closed all your trades and for example you want to withdraw your Bitcoin from your account to your own wallet, you’ll pay the small transaction fee that goes to the BTC miners.

Bybit itself doesn’t charge any fees on deposits and withdrawals. The current mining fees on deposits and withdrawals are stated here.

Trading Fees

Critics of Bybit

Bybit suffers from the same kind of critics as other exchanges operating under the same business model. First of all, the exchange itself doesn’t require you to go through the KYC process, and because of the regulatory reasons, U.S citizens are not accepted. What is more, Bybit is not as liquid as some bigger exchanges, which might lead to some problems if you are planning to trade bigger positions.

As the platform operates only on crypto deposits that are the base for your margin, combining that with a maximum leverage of x100 might lead to some unforeseen consequences. Traders entering a heavily leveraged long position might get quickly liquidated, as the value of the available margin decreases, with the underlying asset increases in the value at the same time.

Funding Fees

Bybit has the same funding fee standard most competitors use: Every 8 hours there is a point where open positions get charged the so called funding fee. This fee gets directly exchanges between traders, so it’s nothing the broker will earn. The fee is dynamically calculated and depending on market conditions it’s either longs pay shorts or the other way round. The time intervals are 8:00 UTC, 16:00 UTC, 0:00 UTC. Funding fees only affect positions being held over those time stamps. If you close a positions one minute before or open a new one right afterwards, you’re not affected.

Our Verdict on Bybit

Bybit is seen by many traders as a robust and reliable platform. So there is no need to be discouraged by the missing verification process. In fact, anonymous (KYC-free) trading is what many traders prefer so they specifically look for crypto brokers with no KYC.

Bybit offers good support for users and it is available around the clock. The possibility to ask the CEO of the company questions via his own Twitter account shows that it is a transparent company. That’s what we like to see in the crypto world.

The platform is made for experienced traders. As with many other platforms, it is possible to first get acquainted with the system via a demo environment. So you can take a look around to see what the dashboard looks like before you really start. A function we didn’t expect, but certainly a pleasant surprise.

Bybit is a cryptocurrency derivative exchange that launched its services at the end of 2018.

The exchange gives traders the ability to trade Cryptocurrency perpetual contracts with up to 100:1 leverage. In their short time in operation, the exchange has managed to build up sizable liquidity.

However, can such a new exchange really be trusted?

In this Bybit review, we will give you everything you need to know about the exchange. We will also give you some top tips when it comes to trading crypto futures.

Get $190 BONUS!*

*On deposits of 0.2 BTC or More

Registration

Bybit is P2P cryptocurrency futures exchange that is based in Singapore. The exchange operates under Bybit Fintech Limited which is a company that is registered in the British Virgin Islands.

In their about us page, the exchange claims that they have a team which is comprised of experts in blockchain technology and finance. For example, their technology team has people who hail from Morgan Stanley, Tencent etc. You can check them out on linkedin.

The primary product offered on the exchange is perpetual futures products with 100:1 leverage. This means that they are trying to compete with established exchanges such as BitMEX and Deribit which have similar non-expiry futures products.

While there are many similarities between the exchanges, there are some unique features that Bybit have included that could make them attractive. We will touch on these features when we cover their trading technology.

The exchange is open to most traders around the world and the website has been translated into English, Simplified and Traditional Chinese, Korean, Japanese and recently Russian. However, there are some jurisdictions that they do not operate in and these include the likes of the USA, Syria, and the Canadian province of Quebec.

Is Bybit Safe?

This is one of the most important questions that any exchange user will have. This is especially true when it comes to a new exchange with no established security track record to turn to.

As such, when we look into the safety of an exchange, we are interested in their security policies as it pertains to their coin management, user security tools and of course risk management.

Exchange Security

To counter the threat posed by hackers, Bybit operates a secure cold storage solution. This means that they store the bulk of their crypto reserves, and all of the clients’ funds, in offline wallets that are stored in a secure “air-gapped” location.

There is only a small portion of their own coins that are kept in their “hot wallets” in order to service the needs of traders when it comes to withdrawals. Moreover, if they ever need to move funds from cold storage, they need to use a multi-signature address scheme.

Multi-signature means that the exchange will need more than one key in order to sign a transaction from one wallet to another. This prevents the risk posed by having a single individual manage all the funds on the exchange.

Encrypted Communication

Bybit SSL Encryption

Go for Green with Padlock

In order to prevent the risk posed by online snoops and phishing attacks, the Bybit website has full SSL encryption. This means that all passwords and address information that you send them will be encrypted.

This is also helpful in order to spot a phishing site. If you are on a website that looks like it could be that of Bybit but it does not have a secure padlock in the browser, it is an immediate indication that you are on a phishing site and you should leave immediately.

Insurance Fund

In order to manage the risk posed by shortfalls in futures contract settlement, Bybit operates what they call their “insurance fund”.

Essentially, this fund will be used in the case that a trader gets liquidated at level that is below their “bankruptcy price”. The latter is the price at which the trader’s initial margin has been completely depleted.

Bybit Insurance Fund

Amount of Bitcoin Currently in Insurance Fund

Without the fund there would be a shortfall whereby the counterparty to the trade would not be made whole. It is essentially an insurance policy that will protect traders in the case that Bybit is not able to liquidate the position at bankruptcy price or better.

These funds are replenished with the initial margin that liquidated traders have at the outset of their trade. The difference between the price at which the trader is liquidated and the bankruptcy price is how much will be sent to, or taken from, the insurance fund.

Two Factor Authentication

While exchange side protection is one thing, in most cases the biggest threat to a trader’s security is themselves. That is why Bybit has included a number of tools that will help protect your account from a hacker with your password.

Google Authenticator App

2FA with Google Authenticator Application

One of the most important tools that they have included is two factor authentication. This means that you will have to use your phone in order to authenticate into your account or send transactions. You have to enable google authenticator before you are allowed to withdraw any coins.

Bybit Leverage

Given that Bybit is a leveraged exchange, it means that they allow crypto margin trades. Traders will only have put up a small percentage of the initial position as collateral for their trades.

This means that if you have a leverage of 100x you will be required to put up a margin of 1% of the initial notional amount of the trade. So, if the notional on a 10BTC contract is $36,000, you will have to put up $360 in initial margin.

Registration

Major Pro

: With Bybit, leverage is freely adjustable, meaning that it can be changed even after opening a position, which is something that cannot be done on other exchanges.

What is surprising about the perpetual contracts on Bybit is their size. Each contract is only worth 1USD which is much smaller than the contracts on other exchanges. Below is all the other specifics of their BTCUSD contract.

BTCUSD Contract Bybit

BTCUSD Contract Specifics at Bybit

They have pretty much the same terms on their ETHUSD contracts and you can find more information about that here. This is different from other exchanges such as BitMEX which, contrary to Bybit, does not offer a 100x leverage product for ETH yet.

Bybit also offers futures contracts on Ripple (XRP) and EOS. However, these contracts have lower leverage levels with a max leverage of 25x. This is actually quite interesting as we have not seen EOS futures contracts at other exchanges. This could give Bybit a competitive advantage.

While Bybit does offer 100x leverage on their contracts, this is not constant. If you are a large trader and are entering sizable positions then they will bring down the leverage that you can achieve on your contract.

This protects the exchange from the risk posed by large positions. Below is the table of the BTCUSD risk limits. You can find the ETHUSD, EOSUSD and XRPUSD risk limits on this page.

Position Value Maintenance Margin Initial Margin Max Leverage

150 BTC 0.5% 1.00% 100

450 BTC 0.5% 2.00% 50

750 BTC 2.5% 3.00% 33

1,050 BTC 3.5% 4.00% 25

1,350 BTC 4.5% 5.00% 20

1,500 BTC 5.0% 5.50% 18

As you can see, the maintenance margin is constant at 0.5% for all contract sizes. However, for larger positions, they will increase the minimum initial margin requirement such that there is a much greater shortfall between the liquidation level and the bankruptcy level.

Liquidation

Liquidation is what happens when you have nearly depleted your initial margin and the mark price hits the “liquidation price”. In this instance, the trader will be liquidated with the rest of their margin, if any, being sent the Bybit insurance fund.

Registration

ADL

Bybit operates an Auto Deleveraging system. Essentially, this happens when a position can’t be liquidated at a price that is better than the bankruptcy price and the insurance fund cannot cover it. The ADL system will automatically deleverage a position of an opposing trader that is selected according to their defined criteria. You can read more about the ADL here.

While there are many traders who may be upset by a liquidation, it is an important risk management tool in a futures exchange. However, Bybit has a number of tools that will help traders avoid the risk of liquidation. These include the following:

Dual Price Mechanism: In order to prevent the risk of market manipulation on the exchange, Bybit will use a dual price mechanism as the contract reference price. This is composed of the “Mark Price” which triggers liquidation and the “Last Traded Price” which is used to calculate the price at which the position is closed. The former is a global Bitcoin price whereas the latter is the current Bybit market price. Using external pricing inputs reduces singular exchange manipulation.

Auto Margin Replenishment: If you want to make sure that your position will always have adequate levels of margin then you can set it to auto-replenish. This means that whenever your margin is close to being depleted, it will draw on your funds to keep your position open

Stop Loss: This forms part of the order options that we talk about below. Having effective stop losses on your positions will ensure that it never gets down to the liquidation level.

Mark / Spot Price

For those interested, the Mark price is derived from the Spot price. The spot price is a Bitcoin price index that represents the global price. It is comprised of prices on Bitstamp, Coinbase Pro and Kraken. The Mark price is the spot price index plus a decaying funding basis rate

Bybit Fees

Trading fees are an important criteria for us because of obvious reasons. This is especially true when it comes to a futures exchange where you are paying fees on positions that are much larger than your margin.

Bybit operates what is called a “maker-taker” fee model. This means that they will charge traders a fee if they take liquidity off their books and they will give them a rebate if they provide liquidity to the exchange.

Confused

If you place an order and it gets executed immediately you are taking liquidity off the books. This is most of the time through a market order. However, if you place a limit order that is away from the current price you are making liquidity and this will get you the maker rebate.

Below are the fees that you will pay for the futures contracts on the exchange. They are the same as BitMEX for BTC but slightly above for ETH (as they propose higher leverage for it) and are below other exchanges such as Huobi.

Contract Maker Rebate Taker Fees Funding Rate Funding Rate Interval

BTCUSD -0.0250% 0.0750% -0.0447% every 8 hours

ETHUSD -0.0250% 0.0750% -0.0447% every 8 hours

EOSUSD -0.0250% 0.0750% 0.0100% every 8 hours

XRPUSD -0.0250% 0.0750% 0.0100% every 8 hours

BTCUSDT -0.0250% 0.0750% 0.0100% every 8 hours

The other fees that you will see when you open the trade is the funding rate. This is analogous to an “overnight” rate and it is a financing charge. Given that margin trading is based on “borrowing” positions, you will either pay a financing charge or be receiving it. However, on the contrary of the transaction fees, these fees are directly exchanged between traders and not Bybit.

The funding rate is determined by market conditions and interest rates. This means that it is not fixed and will vary on a daily basis. You will be able to see the funding rate that will apply under the position details when you open your trade.

In terms of deposit/withdrawal fees, Bybit does not charge you anything on this. However, when you are withdrawing your coins you may incur a miner or “network” fee due to the blockchain mining. This is usually quite small though.

Finally, you have a relatively small $5 fee that you will have to pay on any Asset exchange orders for exchanging physical crypto at spot. We explain that below.

Bybit Registration

Registration

If you have decided that you would like to give Bybit a go then you will have to create an account. In order to do this, they will require either an email or phone number, and a password. If you have been given a referral code then you can use this (more on this below).

Once you have registered, Bybit will send you a confirmation code that you will need to use to confirm your email/phone number. This is only valid for 5 minutes so make sure that you do it right after creating the account.

Privacy Hawks

: Something that many traders may appreciate is the fact that Bybit is a fully anonymous exchange. They do not require you to complete KYC before you can trade. This is great for those privacy hawks who are worried about the risks of certain data breaches.

Once you have confirmed your account and logged back in then you could be offered a deposit bonus. These are a great way to augment your trading funds initially. We give you all these details further below.

Deposit / Withdrawal

Bybit is as crypto only exchange. This means that you cannot fund your account in fiat currency. While this may be annoying for some, you can easily convert your fiat currency into Bitcoin on a number of exchanges such as Bitstamp or Kraken.

In order to deposit crypto you will need to generate a wallet address and initiate a transaction into the wallet. You can do this by heading over to your “Assets” section in the header. This will present your wallet balances where you will select “deposit” and it will bring up the BTC / ETH address.

Wallet Deposit Bybit

Generating your wallet deposit address

Once you have the address, you can initiate the transaction. It will not be instantaneous as the transaction still has to be propagated through the network and confirmed by the Miners.

Confirmations

: Bybit is quite unique amoung exchanges in that they require only 1 blockchain confirmation to credit your account. You can monitor the progress on a blockchain explorer.

Withdrawals are just as easy…

You will hit the withdrawal button on the applicable asset. It will ask for your wallet address as well as to confirm the transaction through 2FA. You will also be given information on the miner fee that will be applied to the transaction.

Bybit processes withdrawal 3 times a day at 0800, 1600, 2400 (all in UTC time). There are withdrawal limits that are set on the accounts although these are not too restrictive. Below are the min / max limits:

Bitcoin: 0.002BTC / 10BTC

Etherem: 0.02ETH / 200ETH

Ripple: 20XRP / 100,000XRP

Eos: 0.2EOS / 10,000EOS

In order to make sure that they always have funds available on their hot wallet, Bybit also has limits on daily withdrawals in total from the exchange. These are set to 100BTC and 10,000ETH. If this limit is reached, you will have to wait for Bybit to replenish it from their cold wallet.